The trust relationship between the state and the private sector has deteriorated rapidly over the last five years.

Ryk van Niekerk 14 August 2017

President Zuma’s term in office has wreaked havoc on the SA economy. Picture: Reuters/Rogan Ward

The notion of a tax boycott seems to creep into many casual conversations among taxpayers.

Recent revelations of the extent of corruption and flows of billions to Dubai, do not sit well with those funding state coffers, and rightly so.

Ignoring the merits and possible consequences of such a revolt, the practical prospects of a wide scale tax boycott are limited. But many South Africans may be oblivious to a massive investment boycott by the private sector that is on the go.

This boycott began when President Jacob Zuma took office and has steadily gained momentum over the last five years as the trust relationship between the state and private sector deteriorated.

In fact, the distrust – or trust deficit in the language of politicians – is accelerating. The reasons are quite intuitive: Corruption that is out of control, state capture and new populist policies that are akin to government hitting the self-destruct button.

The latest example is mineral resources minister Mosebenzi Zwane’s efforts to destroy the mining industry through a combination of incompetence and malevolence. Even though finance minister Malusi Gigaba – who is also under a cloud – seems to try and change perceptions about government’s intent, Zwane’s actions alone will have a profound impact on many other sectors.

It is therefore not a surprise that private enterprises only invest the bare minimum.

Gross Fixed Capital Formation

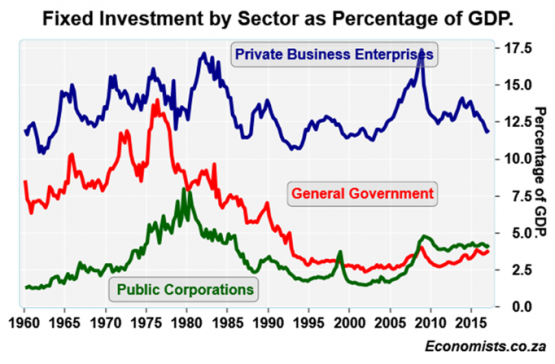

The extent of the investment boycott is evident in various economic indicators, most notably in the recent trends of South Africa’s Gross Fixed Capital Formation (GFCF). It measures the investment in productive assets such as factories, machinery, equipment and other employment generating industries, and is a leading indicator of future economic growth. According to the latest Reserve Bank Quarterly Bulletin, the private sector’s contribution to total GFCF in the local economy dropped from 70% in 2008 to 60% in 2016, which resulted in the total GFCF as a percentage of GDP falling from 23.5% to 19.6%.

To put this in perspective, the target of the National Development Plan is 30%.

Other indicators show this too. A recent survey by the University of Johannesburg’s Centre for Competition, Regulation and Economic Development suggests there is up to R1.4 trillion (cash) just on the balance sheets of the 50 largest companies on the JSE.

This is 35% of SA’s GDP, sitting idle! There are 350 other listed companies and many other large unlisted enterprises who are also desperately clinging onto cash, which could easily match the R1.4 trillion.

Risk is not worth it

The reason for the boycott is quite simple. The private sector, as resilient and innovative as it can be, is very predictable. Private enterprises will only invest if the potential rewards of new ventures justify the risk, especially if payback terms are north of ten years – as is the case in the mining and manufacturing industries.

Read more on …

https://www.moneyweb.co.za/news/south-africa/sas-massive-investment-boycott/ 20 August 2017